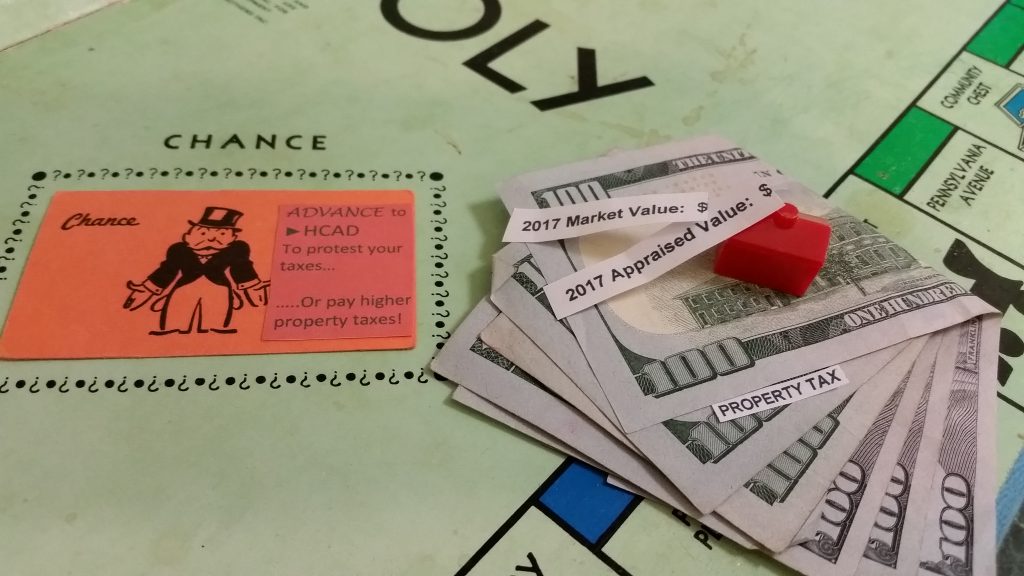

Every year on January 1, Texas law mandates that our properties are assessed in order that we pay our pro rata share of the various tax burdens for each jurisdiction. Around March the Harris County Appraisal District (HCAD) will send you your notice of appraised value. The computerized assessment of your property’s value is likely off base.

If you feel that the value of your property is wrong, my recommendation is that you protest your taxes. Some protest every year, as thousands of homeowners and business owners attempt to slow the annual increases in assessed value. The deadline to protest is now mid-May for Harris County. Note: These are my tips, and not legal advice.

There are 3 ways to tackle protesting your taxes:

1. Do it yourself in person at the HCAD (located off Hwy 290)

File electronically or mail in your protest form. Be sure and check both these reasons why you are protesting: “value is over market value,” and “value is unequal compared with other properties.” When you go to protest at your informal hearing, if you don’t check both boxes, you can’t submit your proof/evidence for the one reason you did not check.

Be sure and do your homework by taking photos of damage, cracks, and areas in need of repair, along with gathering your valuation evidence (a Realtor (www.melissarowell.com) can help you get comparables or “comps” for your home). Check the HCAD website for the evidence on how they came to your valuation. They gather data from various sources, and it may not be confirmed.

You will start with an informal hearing at HCAD on a date they assign to you. Bring all your documentation and photos with you to that informal hearing. If there is no resolution on the valuation at the informal hearing, then you will be assigned a new hearing date to meet with the appraisal review board (ARB).

At the ARB hearing, bring 5 copies of all your documentation, one for you, one for the HCAD employee and one for each of the 3 independent citizens. Dress professionally and be polite and friendly. You will have a 15-minute meeting and hopefully you will leave with HCAD agreeing to your reasonable valuation or a valuation that both can agree on.

Be sure and save your documents as you may have to make the same arguments on your valuation year after year.

2. Have a property tax protesting company protest for you. It will cost you a portion of your tax savings when they win.

3. Start protest online using HCAD’s iSettle feature

Log on to HCAD’s website to use iSettle. Refer to #1 above for instructions. If you go this direction and you don’t like the valuation that HCAD offers, you can then have a hearing scheduled to meet with the appraisal review board (ARB).

Additionally, please confirm your building data, including extra features and outdoor features while at your hearing.

Finally, be sure you are getting your “residential homestead” exemption if it applies in your area of the county/ISD, and the home is your primary residence. You can log on the HCAD website and confirm the exemption. You will save 20% off the value AND it caps the appraisal increase at 10% per year. Some ISDs offer up to an additional $25,000 off your value that you won’t pay taxes on. To find out how much of an exemption your jurisdiction in Harris County allows, go to http://hcad.org/search/jurisdictions/. Other possible exemptions are: Over-65, Disabled Person and Disabled Veteran.

For more information: www.hcad.org, http://hctax.net/Property/Workshops, https://youtu.be/9gAaZUGhb34.

My goal is for you to benefit from this information and use it to successfully protest your taxes. If I can help save you money, that excites me!

For more details, email me @ melissa@melissarowell.com. Reach out to me if I can help with your real estate needs, and exceed your expectations!

Melissa Rowell, RE/MAX Signature